Market calm masks deeper risks

main text

Market calm masks deeper risks

NYSE

Traders on the floor of the New York Stock Exchange in May. After shares dipped folllowing the announcement of new tariffs, stock prices have mostly settled near record highs at the NYSE.

The second quarter is coming to an end, and I am starting to perceive an eerie sense of calm in the financial markets and the most recent economic data.

Under normal circumstances, I would welcome calm conditions — it's summertime, after all. But all of the economic tumult of the past few years has caused me to become more cautious.

My confidence in periods of market and economic calm has been replaced with concerns about market complacency. As a result, the things I cannot yet see in the data are becoming more worrisome than what is apparent on the surface. Let me explain.

Sign up here for the next Numbers That Matter Live, June 24 at 2 p.m. Eastern

This quarter started with the stock market in free fall, and consumer confidence data also registered a sharp decline at that time. These trends started in the first quarter, and the catalyst for them was uncertainty about the pending tariff regime.

But shortly after President Donald Trump proclaimed "Liberation Day," the stock market reversed its downtrend. It has been in rally mode ever since. The S&P 500 is now up about 2 percent for the year to date, and at the time I write this sentence, it is trading just nine points below its all-time high.

At the same time, the most recent economic data from the Bureau of Labor Statistics, pertaining to both the labor market and the trend in inflation, have been surprisingly good. Job growth in the second quarter has, at least so far, exceeded expectations, while prices have increased more slowly than anticipated.

So what's the problem?

I actually have two problems with this new sense of calm at the present moment. First, I cannot see where the risks to future economic growth have changed all that much since April 2. It is true that many of the exorbitant tariffs that were threatened in the beginning have been walked back, but we are a long way from experiencing — and accounting for — the impact of the tariffs that are almost certain to remain in effect.

The initial reactions from the financial markets, business managers and households in anticipation of this new economic order were a bit overwrought as the second quarter started. But I have not seen anything in the data or in announcements from the White House to suggest that the market should be trading near or above its all-time high. There is still just too much downside risk.

Gross domestic product data from the second quarter will not be released until the last week in July, but I expect it will show positive overall growth. The growth rate will not be negative like it was in the first quarter of this year, but I believe we will see a noticeable deceleration in both business investment and household spending. The huge surge in imports that pushed the overall GDP figure into negative territory in the first quarter is behind us, but I think current trends in investment and consumer expenditures — the sectors that drive economic activity — are weakening.

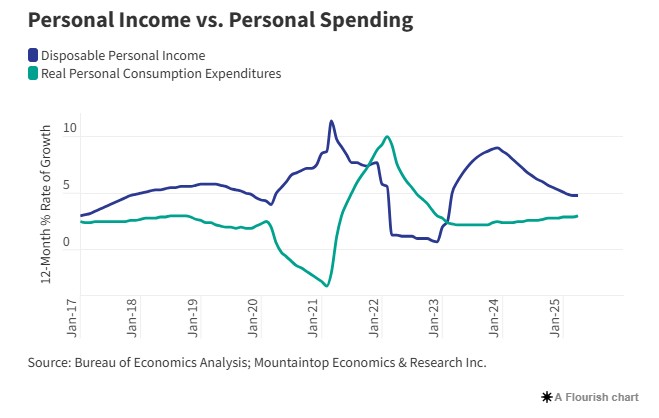

As always, I could be wrong. So I will continue to monitor closely the data from two of the most important economic indicators in the whole U.S. dataset: inflation-adjusted consumer spending and disposable personal income.

At the present time, the chart of these two indicators looks rather good. The growth rate for disposable personal income during the past year was almost 5 percent, while the growth in real household spending was a healthy 3 percent. I am heartened by the fact that real spending is gradually accelerating, and that incomes are growing faster than spending, which indicates there is also money going into personal savings and investments.

The current relationship in these graphs is similar to what it was before all the distortions caused by the COVID-19 pandemic. Looking at this graph, it is easy to see why the financial markets might be feeling a bit overly optimistic about the future of the economy. As of April — the last month represented on the chart — Americans had plenty of money to spend, and they were increasingly spending it.

But as we saw just a few years ago, the trends in these lines can change quickly. That does not mean they will, but I remain wary of the possibility. It will take more than carefully curated news releases out of the White House to convince me there will not be any future distortions in the data.

These graphs should eventually tell the story of the underlying health and resiliency of the U.S. economy. Unfortunately, these data lag the present moment by a month or two, and once we get the data, it may then take a couple more months to confirm a change of direction in the trends. But until I see confirmation in the data, we are still in a period of transition and potential economic disturbance.

The second problem I have with the current state of complacency in America is the situation with the federal budget deficit and the rising U.S. debt. I have consistently railed against this issue for my entire career, but it feels like it became more acute when the U.S. House of Representatives recently passed President Trump's "big, beautiful budget bill."

I have never met anybody in the plastics industry who disagrees with me when it comes to this issue. I thought there might have even been some alignment with the Trump administration on this when we were introduced to the newly created Department of Government Efficiency. But then I see the proposed budget, and I see they are not even going to try to pretend they care about the deficit and debt levels.

So those are the risks that will not allow me to relax and enjoy the pleasant weather without worry: the unresolved uncertainty pertaining to the potential problems with tariffs and trade, and the increased risks associated with ever-rising debt. These risks have not had any noticeable effects on personal income and spending, and I hope they never do. But I will not take our current state of prosperity for granted.

* Source : https://www.plasticsnews.com/news/markets-rally-risks-remain-economic-calm-masks-deeper-concerns

* Edit : HANDLER

- PreviousTariff turmoil as trade tensions intensify 25.06.19

- NextWoojin Plaimm Newsletter, June 2025, Vol.26 25.06.19